2022-06-07

2022-06-07

As a way for investors to hold tokens to earn interest, and it is also the most indispensable part of the current DeFi design, Staking is widely known by crypto rookies and trading veterans.

Massive Investors focus again on the Staking Economy, with the merger of Ethereum Mainnet and Beacon Chain。 Up to now, StakingRewards figures show that the cumulative staking value of the PoS public chain exceeds $190 billion, with more than 4.7 million addresses participating in the staking around the world, and the average rate of return for staking users exceeds 7%.

More than 100 public blockchains have adopted the PoS consensus mechanism, enabling Staking to be a Blue Sea to be developed. And many third-party service providers have appeared on the market to help users solve the high threshold of Staking directly in the public blockchain (it requires a lot of capital, technical knowledge and equipment investment),such as node operators, centralized exchanges with staking functions, various decentralized liquidity staking service providers, etc.

Although these third-party service providers can help users better Staking, they also have many problems, for example, there are many types of node operators, and users not only have to spend time screening, but also face the risk of choosing the wrong one; although CEX is convenient, its investment has an upper limit, and the rate of return is generally not high due to the middle commission; liquidity staking service providers have high yields, but few can meet the needs of multi-chain.

At this time, KiKi Finance——a promising Staking star stands out, it is a Multi-chain Aggregated Staking Protocol dedicated to breaking the public chain barrier, continuously integrating Staking assets with high market value and high APR, allowing users to achieve multi-chain layout on one platform.

Although the DeFi head pattern based on the Staking track is far from being formed, there are already many strong players on this track. Next, let's explore the comprehensive strength of KiKi Finance to see what advantages it has to surpass its predecessors. At the same time, it also looks at the current situation and future development trend of the Stacking track through comparison.

Part 1 KiKi Finance is a Multi-chain Aggregated Staking Protocol

As mentioned above, the core function of KiKi Finance is to provide a one-stop decentralized Staking service. Users complete node voting on chain through KiKi Finance to get high APR rewards.

In order to further improve the user's income level ,KiKi Finance provides a high-yield liquidity mining pool in addition to the Staking. Users can obtain higher returns than ordinary Staking through the combination model of Staking+Farm.

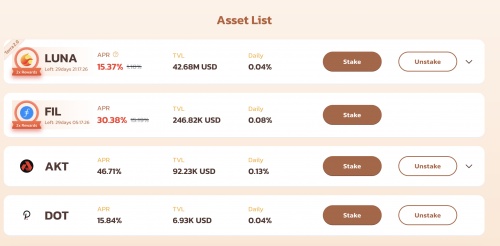

Because of the natural attractiveness of this dual-income model, TVL exceeded $100 million in less than two months after the launch of KiKi Finance,and the TVL of LUNA staked by the platform alone is close to $90 million. Currently, KiKi Finance supports assets of Polkadot, Cosmos, Kusama, Terra2.0, etc. More assets will be launched from time to time, such as the FIL,new LUNA,ATOM,XPRT,SCRT,CASPER.

KiKi Finance team has been working on Staking node services for many years, serving head exchanges, investment institutions and whale customers for a long time, and maintaining more than 5000 nodes. It is precisely because of the leading node operation technology and years of experience in Staking Mining Pool that KiKi Finance has a very precise understanding of the industry and grasps the demands of users, and has launched a multi-chain aggregated Staking service with high market demand.

At present, KiKi Finance has received investment from many well-known venture capitals such as FBG CAPITAL, NGC Ventures, Huobi Ventures, CoinSummer and GEEKCARTEL, which will help KiKi Finance lay a good user foundation for the future development to a certain extent.

However, it is not enough to break through in the Staking track. With the continuous emergence of track participants, the competition will be further intensified. How can KiKi Finance retain users?

So we will compare and analyze the top and popular projects in this track (Lido, Stader, pSTAKE, Ankr, and the representative of CEX staking, Binance staking) from the perspectives of multi-chain, revenue, user threshold, and token value capture to understand the competitive level of KiKi Finance.

Part 2 The comprehensive strength of KiKi Finance

The following is a brief introduction to the above projects before analysis and comparison.

Lido is the largest staking service provider of Ethereum consensus layer and a well-deserved leader in the ETH staking track.

Stader is a core staking middleware infrastructure for multiple POS networks, providing services such as staking pools, liquid staking, and staking reward games. Currently, it is mainly used in Terra.

pSTAKE is a liquidity staking protocol used to unlock the liquidity of staking assets.

Ankr, the Web3 blockchain cloud infrastructure platform, will soon launch the decentralized staking protocol Stkr.

Binance staking is the staking of Binance CEX.

(1)User threshold

The above products all provide staking services, but different protocols target different users. Stader's user interface is relatively complex, as it serves multiple customer segments such as retail crypto users, exchanges, custodians, and mainstream fintech players, so it takes some time for staking beginners to explore.

Binance staking is aimed at exchange users, the operation steps are very simple. Even for assets of different chains, users can realize one-click staking without switching wallets. However, there is a minimum staking limit for participating in Binance staking, and users do not have the flexibility to withdraw. In addition, Ankr and pSTAKE also set minimum staking limits for different assets.

Lido and KiKi Finance are much more flexible, there is no minimum investment limit, the staking interface is also very simple, the staking assets and APR are all at a glance, which can meet the staking needs of users at all levels.

(2)Multi-chain

At present, the most abundant choice of multi-chain assets is CEX, users can make profits by directly entrusting the idle assets in the account to the exchange. Due to the high management cost of the exchange, the user management service fee charged is also higher than the decentralized staking protocol, resulting in a generally low income level.

In this era, in addition to Ethereum, Terra, Cosmos, Polygon, Polkadot and other public chains also have a lot of staking demand for decentralized staking protocols. If users can participate in the staking of multiple public chains and reduce the cumbersome steps for users to switch between wallets and protocols, it will definitely attract different types of users.

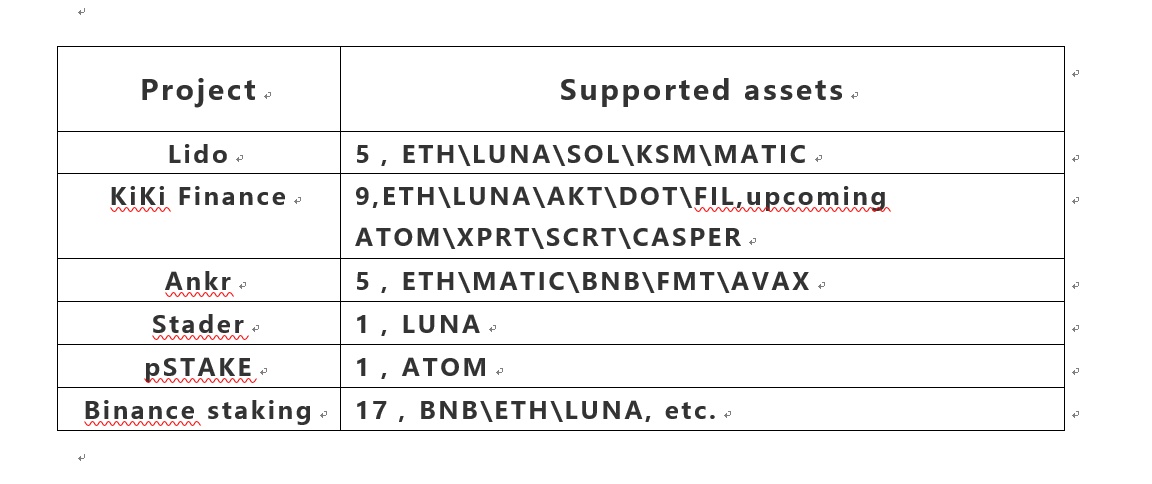

At the early stage of the development of decentralized stacking protocol, popular public chains were generally supported first. Lido supports five assets including ETH, LUNA and SOL. Ankr supports five assets including ETH, MATIC and BNB. Both Stader and pSTAKE support only one asset. KiKi Finance supports 9 assets: ETH, LUNA, AKT, DOT FIL and the upcoming ATOM,XPRT,SCRT,CASPER.

So whether to support multi-chain assets has become a manifestation of the competitiveness of the Staking protocol, and it is also a major development trend in the future. This is a huge test for the project's own multi-chain node screening ability and the security operation ability of staking node.

KiKi Finance team was responsible for the largest staking pool in the entire network. The nodes it has served include ETH2.0, Terra, SOL, AVAX, and ATOM, etc., and it manages more than 50 projects of PoS, DPoS, and Masternode. Such rich experience will surely lay a good foundation for KiKi finance's multi-chain layout in the later stage.

(3)Revenue

All Stacking revenues come from the inflation of the POS network. Since it is difficult for users to directly participate in Staking node, they mainly rely on various third-party operators, and token holders need to pay them a certain service fee (directly deducted from the staking income).

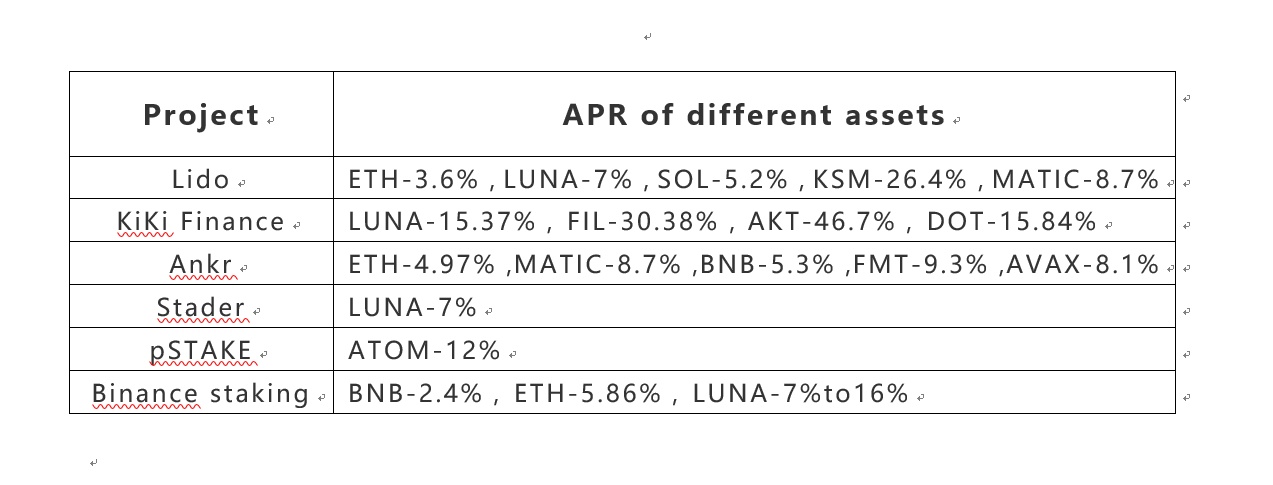

Different staking operators charge different service fees, in general, the service fee of CEX is higher than that of DEX. The APR of ETH staked in LDO is 50% higher than in Binance exchange, which is only 2.4% (with a 30-day minimum period).

According to the APRs of different assets displayed on the official website of the major protocols, it is found that even for the same assets, the APRs of various exchanges are quite different. The APR of LUNA staked in Lido and Stader is only 7%, but it can reach 17.9% in KiKi Finance, and the revenue is 2.5 times that of the former.

This shows that KiKi Finance not only has good node staking resources, but also chooses to benefit users, and the management fee charged is far lower than the industry level. This can help KiKi Finance better acquire users in the future. After all, under the same security level, the first goal of participating Staking users is to obtain higher revenues.

(4)Token value capture

The staking agreements mentioned in the text have issued tokens (LDO of Lido, SD of Stader, pstake of pstake, ankr of ankr, Kiki of Kiki Finance), which are mainly used as reward tokens. In order to encourage users to hold tokens,instead of "mining, withdrawing and selling", most protocols will add added value to tokens.

Lido endows LDO with governance functions, which is also a commonly used empowerment method for many DeFi protocols. In addition to governance, some tokens will expand the application scenarios of tokens. For example, Stader users can use SD to reduce fees in the ecosystem, and Ankr allows users to use ANKR to pay for high-quality services.

KiKi Finance makes full use of high yield to obtain token value. It adopts the combination of "Staking+Farm" to provide users with higher APY rewards of mainstream tokens than other platforms. This method encourages users to hold platform tokens for a long time, allowing the asset value to settle in the network, reducing the selling pressure on the secondary market to a certain extent.

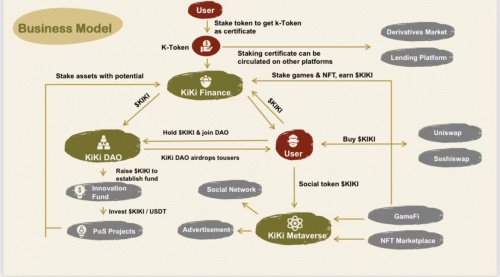

KiKi Finance adds multiple application scenarios to KIKI through a well-designed economic model.

First, KIKI holders will have the opportunity to receive token airdrops from multiple staking projects on the platform to obtain revenues.

Second, KIKI can be used to purchase limited NFTs and game assets in the future as social tickets for KiKi Finance.

Third, KiKi Finance will set up KiKi DAO, where KIKI users can participate in voting to decide which projects can be listed on KiKi Finance in the future, and holders of geek spirit will also participate in the core content of KiKi Finance technology development.

Therefore, KIKI is completely different from the governance tokens of ordinary DeFi and Staking protocols. It has value-added benefits, the longer it is held, the more opportunities to get rewards. Users who participate in decision-making will gain more revenues from DAO governance after the launch of KiKi DAO

KiKi Finance team will regularly repurchase KIKI with 80% of its income. The more the number of repurchases, the less circulating on the market. This sense of scarcity directly pushes up everyone's imagination of KIKI's value-added.

In summary, KiKi Finance is not inferior to the predecessors of the Staking track in terms of comprehensive strength,and has its own advantages. KiKi Finance simplifies the steps for users to participate in Staking to the greatest extent and reduces the entry threshold for users to Staking. KiKi Finance effectively stabilizes the return on investment at more than twice the normal return rate through the token economic model, helping users add value and endowing tokens with more functions.

Part 3 Kiki Finance is not limited to Stacking

At present, the staking value of the Staking track exceeds $190 billion, but the proportion of staking tokens in the Staking protocol to the total staking value of the market is very low, with a penetration rate of only 7%. There is still huge room for development in the Staking market.

Thanks to the few safe and convenient staking products directly facing users, KiKi Finance can gain a firm foothold in the fast-growing market through differentiated services.

In fact, KiKi Finance's white paper shows that Staking is only a starting point for it to embrace DAO and Web3, and KiKi Finance wants to do more than Staking.

The first stage of KiKi Finance is to build a multi-chain aggregation Staking platform and become the traffic portal of the KiKi ecosystem. In the second stage, Kiki Dao will be launched to bring more rights and interests to platform users, it will also work with the Innovation Fund to make decisions on POS investment projects. In the third stage, Kiki open platform will be launched to cooperate with multiple GameFi platforms to provide these platforms with third-party services such as game asset staking and loan. In the fourth stage, KiKi Metaverse is born, where users shape their personal image and realize platform social freedom.

The essence of market competition is often not to stare at competitors, but to serve users, KiKi Finance has planned a long way on this point.

Kiki Finance is not limited to Stacking, but continues to bring innovation to users, providing users with a platform integrating revenue, decision-making, games and social networking, so that token holders can continuously benefit from innovation. The ultimate goal is to create a cohesive super community.

At this stage, what KiKi Finance has to do is to polish the product of Staking to the extreme, so as to attract a large number of users and lay a solid foundation for its lofty vision. It is expected that in the increasingly fierce competition on the Staking track, KiKi Finance can stand out and occupy a certain share steadily.